Average percentage of taxes withheld from paycheck

Louisiana has three state income tax brackets that range from 200 to 600. The amount of a PPP loan is approximately equal to 25 times the applicants average monthly payroll costs.

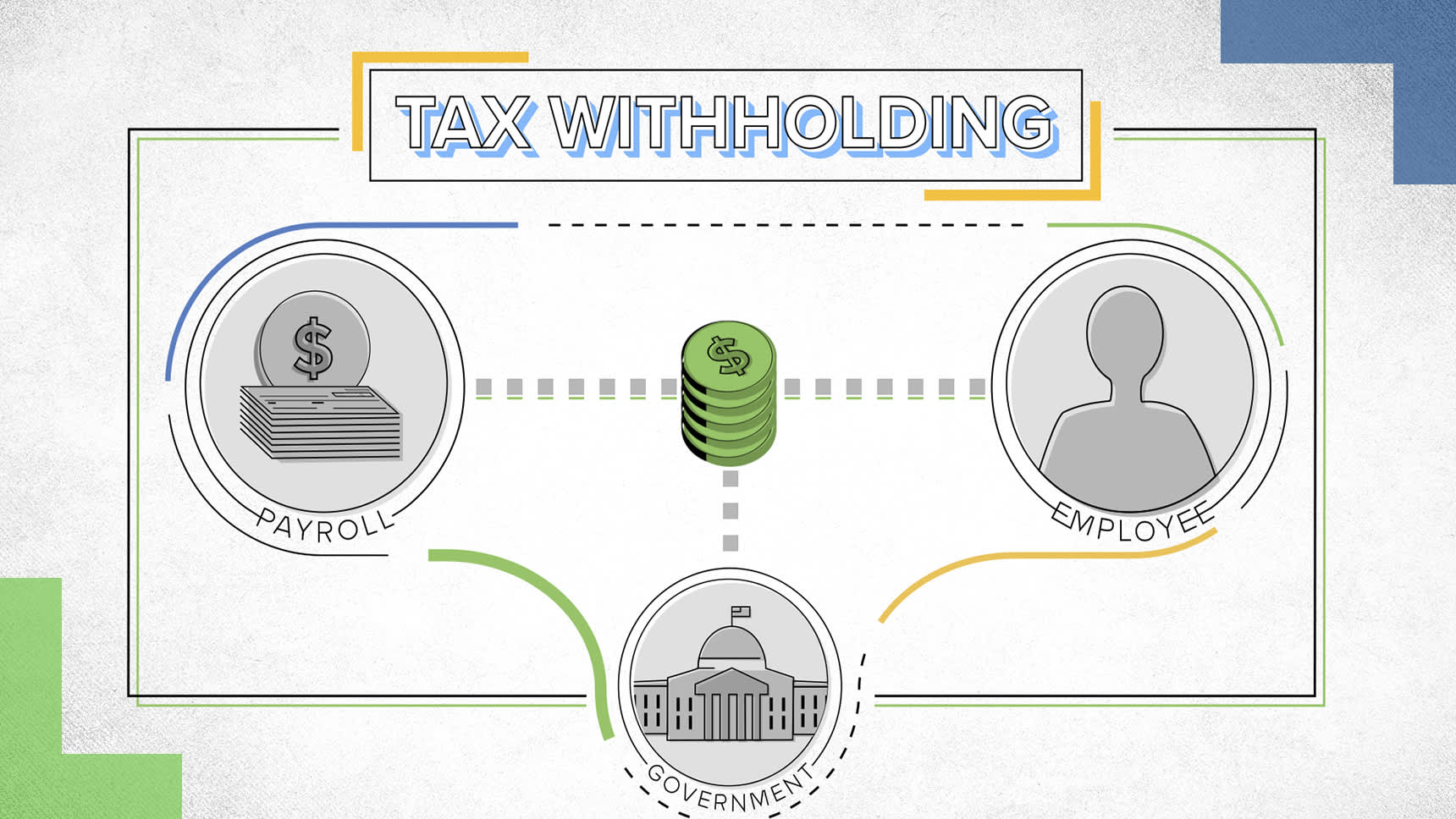

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Of course youll have federal taxes deducted from each paycheck along with your state taxes.

. See Form 5329 Additional Taxes on Qualified Plans Including IRAs and Other Tax-Favored Accounts to figure the excise tax. 27 Furnish each other payee a Form 1099 for example Note. Gross Paycheck --Taxes-- --Details.

How Your Texas Paycheck Works. Payroll costs include taxes withheld from employees wages and all state and local taxes assessed on. Money Sense E-newsletter Each week Zacks e-newsletter will address topics such as retirement savings loans.

Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also withholds taxes from your pay. Withheld and employer social security taxes Form W-3 with the SSA. We use the current total.

Overview of Oregon Taxes. Overview of Louisiana Taxes. The Withholding Form.

Taxes Withheld From a Paycheck and the W2 Do Not Show the Same Amount Free. The excise tax applies to each tax year the excess contribution remains in the account. If you want even more control over your tax withholding you can also specify a dollar.

However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed. You and your employer will each contribute 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. This rate went up temporarily in 2020 and 2021 but by October 2021 it was back down to 73.

Alternatively you can consider adjusting your W-4 form so that you have less money withheld. There is a line on the W-4 that allows you to specify additional withholding. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

Typically save less than 10 of their disposable income which is only whats left over after taxes have been deducted and necessary bills have been paid. Documentation showing the average number of FTE employees on payroll during the borrowers chosen reference period if using the standard form or showing the average number of FTE employees on payroll employed by the borrower on January 1 2020 and at the end of the covered period if using the EZ form. One of the simplest ways to do this is by adjusting your withholdings when you file your W-4.

The TCJA eliminated the personal exemption. The Beaver State also has no sales taxes and below-average property taxes. B Calculation of average number of employees-- For purposes of subparagraph A the average number of full-time equivalent employees shall be determined by calculating the average number of full-time equivalent employees for each pay period falling within a month.

The amount of federal income taxes withheld will depend on your income level and the withholding information that you put on your Form W-4. That 250 would be pulled for your insurance payment and youd pay taxes. Individual plans on the healthcare exchanges range from an average of 648 to 273.

You cant escape your income taxes but you can take steps to change how much of your income taxes you pay each paycheck. The IRS made notable updates to the W-4 in recent years. The simplest way to change how much tax is withheld from your paycheck is to ask your employer to withhold a specific dollar amount from each of your paychecks.

Over the same span the percentage of men who claimed at FRA rose from 128 percent to 211 percent and the percentage who claimed after reaching FRA rose from 45 percent to 11. In some cases an applicant may receive a second draw typically equal to the first. Residents of the greater Portland metro area also have to pay a tax to help fund the TriMet transportation system.

Overview of Arizona Taxes. 10 Withheld and employer Medicare taxes. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. Though sales taxes in Louisiana are high the states income tax rates are close to the national average. We account for the fact that those age 50 or over can make catch-up contributions.

Employer-sponsored plans average 62250 a month with individual employees paying 105 of that for example. How You Can Affect Your Alabama Paycheck. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

These are contributions that you make before any taxes are withheld from your paycheck. The Paycheck Protection Program PPP. In other words average earners in the US.

The 402 percent of nondisabled men who claimed benefits at age 62 in 2015 represent a decline from the 557 percent who did so in 2005. You may see more money withheld from each of your paychecks depending on your companys insurance offerings. Due date of deposit generally depends Form 1099-NEC 10 on your deposit schedule monthly or File Forms 1099 and the transmittal Form semiweekly.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. In the table tax year 1 for example means your first tax year ending on or after the date of the contribution. When you file your taxes consider having your refund deposited directly into your emergency account.

No Louisiana cities charge local income taxes on top of the state rates. We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and assume these numbers will grow with inflation over time. 3 Reduction relating to salary and wages-- A In general--The amount.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. Your employer needs to offer a 401k plan. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Say for example you want to withhold 50 from each paycheck. Oregon levies a progressive state income tax system with one of the highest top rates in the US at 990. There are no local income taxes.

Full-time Equivalent Employees. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month. Arizona has a progressive tax system with varying rates depending on your income level.

Instead of using allowances the new form applies a five-step process that requires filers to prove and enter annual dollar amounts for any. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. Federal Income-- --State Income-- --.

Overview of Maryland Taxes Maryland has a progressive income tax system with rates that range from 200 to. The following table shows the percentage of income from the property that you can deduct for each of your tax years ending on or after the date of the contribution. How You Can Affect Your Vermont Paycheck.

There are four tax brackets that range from 259 and 450. A small employer is generally an employer who had an average of 50 or fewer employees during either of the last 2 calendar years.

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Does A Small Business Pay In Taxes

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Social Security Contributions In Canada Revenue Rates And Rationale Hillnotes

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

What Are Marriage Penalties And Bonuses Tax Policy Center

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Tax What It Is How To Calculate It Bench Accounting

2022 Federal State Payroll Tax Rates For Employers

What Is A Payroll Tax Payroll Taxes Payroll Tax Attorney

Income Tax Form 1040 Record Group 56 General Records Of The Department Of The Treasury 1913 Tax Forms Federal Income Tax Income Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow